As the world adjusts to the new normal, some organizations are struggling to adapt whereas others are thriving. Credit unions are no different. COVID-19 has caused disruption to the normal credit union operations and has economically impacted many members and employees. Credit unions are weathering this pandemic by caring for the needs of their members and by embracing digital banking and additional lending technology. Many credit union leaders are exploring creative ways to grow and are taking a closer look at strategic mergers and acquisitions (M&A).

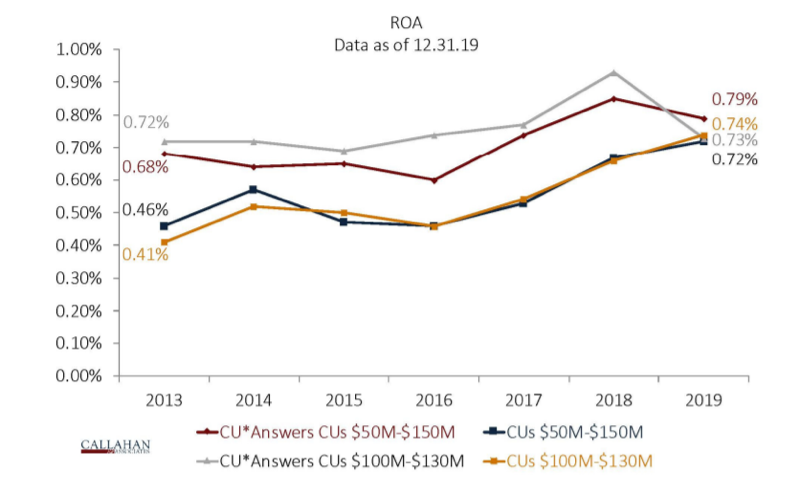

Strategic external growth options, specifically acquisitions, are different from credit union consolidations or mergers, many of which are driven primarily by cost-savings that result from combining the two entities. Strategic acquisitions focus on long-term growth and can involve acquiring, partnering with or investing in a CUSO or another organization (from outside of the credit union market). Strategic M&A is an important tool that can generate non-interest income and allow credit unions to create unique value for their members. A recent white paper published by NACUSO has shown that CUs with CUSOs outperform their peers in Return on Assets.

Here are four tips for credit unions considering growth through strategic M&A.

- Develop a strategy – Preparing for external, or inorganic, growth opportunities should be a part of every strategic plan. Your overall growth strategy should be the primary driver and guide for your acquisition. While this is a simple principle, it can sometimes be forgotten in the excitement of the deal. It is important to focus on the best interests of the members and key stakeholders. While strategic acquisition can be a powerful and rapid tool for growth, investing in or buying the wrong organization (not aligned with the overall organizational strategy) can be an expensive mistake!

- Use a demand-driven approach –For many credit union leaders with limited time and resources, determining which ideas to pursue can be a challenge. One of the most effective ways to evaluate and discover the best opportunities for growth is to be demand-driven. This means evaluating opportunities based on the needs and wants of your members today and in the future. Credit unions should select and prioritize their top markets (or products or services) before researching individual organizations to partner with or acquire. In order to increase your likelihood of success, we strongly recommend selecting a market prior to identifying acquisition targets or potential partners.

- Establish criteria with measurable objectives – Developing criteria will establish a benchmark for evaluation and enable you to select the best partner for growth. There are more and more credit unions seeking out collaborations and CUSOs to quickly fill voids in expertise. There is a growing emphasis on shared services and partnerships as credit unions recognize that they can’t – and shouldn’t – handle everything internally to maximize resources and efficiency. Criteria should be aligned with your overall strategy and can include metrics like growth rate, size, geography, members, or key players/expertise. We suggest picking six criteria – too few and you won’t cover all necessary aspects, and too many will cause you to lose focus. Begin your research at a high level and then progressively zero in on individual market segments and prospects you find attractive as you gather more information. Use your criteria to make objective decisions based on facts rather than relying on intuition alone.

- Expand beyond your “usual suspects” – There’s nothing wrong with pursuing “usual suspects,” or organizations that are already known, but they should not be your only source of candidates. Turning to these organizations alone may mean you are ignoring a whole host of opportunities that could be strategically valuable partners. Conducting market research in a targeted area will likely help you identify fresh prospects that you didn’t even know about.

Strategic M&A is a valuable tool that every credit union leader should consider. Especially in today’s environment, the right acquisition or partnership can swiftly help your credit union meet the changing needs of your members and drive long-term growth. The goal is not to survive, but to thrive.

This post was originally published by John Dearing (Partner, Capstone) on CUInsight.