Getting your credit union’s board onboard with CUSOs As volunteers, credit union board members willingly give of their time, talent, and support. Their selflessness and dedication are living examples of the “people helping people” mantra of the credit union industry. Of course, anytime you bring a group of individuals together for a shared purpose, you …

Category: M&A and External Growth

Capstone’s John Dearing Shares Thoughts as Part of Strategic Growth White Paper

Capstone’s John Dearing Shares Thoughts as Part of Strategic Growth White Paper Capstone Partner John Dearing provided expertise and insight for a recent white paper published by America’s Credit Unions’ CEO Council. Leveling Up: Leadership Through Asset Size Growth examined ways to potentially increase credit union asset size through both organic and inorganic growth. Dearing …

When Your Wish Can Go Too Far

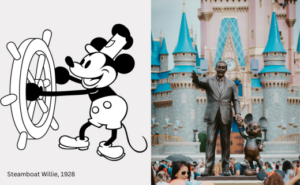

When Your Wish Can Go Too Far How problematic acquisitions and lack of a clear strategy have left the Mouse feeling trapped By Abigail Iaconis, Capstone Senior Analyst The Walt Disney Corporation has one of the most iconic brand images on Earth. Founded as the humbly named Disney Brothers Cartoon Studio in 1923, the company …

2024 State of the Market Survey

2024 State of the Market Survey Near the end of 2023, Capstone Strategic, Inc., a Vienna, Virginia based consulting firm specializing in middle market Mergers and Acquisitions, reached out to nearly 700 current and former clients to collect their thoughts and opinions on the growth environment in their industry and how they felt about near-term …

Structure – The Final Variable in Your Selling Equation

Structure – The Final Variable in Your Selling Equation By Brian Goodhart The final component of Your Selling Equation is Structure. The very word gives me the chills as structure is such a big topic and covers so many potential areas. I often hesitate to treat it as a singular component because it’s just not. …

Operations – The Fourth Variable in Your Selling Equation

Operations – The Fourth Variable in your Selling Equation By Brian Goodhart The essence of the Operational component of your selling equation is the fundamental question of whether the owner’s departure upon sale would cause a material disruption in the performance of the business. In a perfect world, a business owner would be able to …

Timing – The Third Variable in Your Selling Equation

Timing – The Third Variable in Your Selling Equation By Brian Goodhart Timing, as they say, is everything. Well not exactly everything, but it is very important. And it is yet another deeply personal factor that comes into play whenever deals are contemplated. In my last post I discussed Involvement and how each business owner …

Involvement – The Second Variable in Your Selling Equation

Involvement – The Second Variable in Your Selling Equation By Brian Goodhart Involvement is perhaps one of the most complex and personal variables involved in the selling equation. Unlike valuation, there are no trained professionals in this field who use proven methods to arrive at a mathematically sound option. Involvement is inherently personal and as …

Value – The First Variable in Your Selling Equation

Value – The First Variable in Your Selling Equation By Brian Goodhart Value is the first variable in your selling equation and for good reason – it is the one talked about the most and the metric by which most people determine the success or failure of a deal. In order to adequately discuss value, …