Author's posts

Manufacturing Growth Through Acquisition: What to Know and What to Ask

In the current issue of Supply Chain Management Review, Capstone CEO David Braun offers both advice, and some vital questions to answer for those manufacturing and supply chain companies who may be considering growth through acquisition. https://www.scmr.com/article/manufacturing_growth_through_acquisition_what_to_know_and_what_to_ask

As Business Owners Age, the Future of Their Companies Often Left in Doubt

Workers of the baby boom generation continue to retire in great numbers. Many of their fellow Boomers who are business owners are also planning retirement. That is creating a new set of challenges for them, and for the economy. According to information from the U.S Census Bureau, Boomers own over 2 million small businesses, employing …

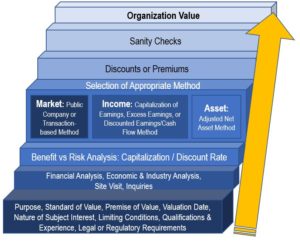

Credit Unions: Valuation Process Steps

With the rising number of credit union mergers, the increasing interest in acquisitions of community banks and branches, as well as investments in fintechs by credit unions and CUSOs, understanding valuation – processes and techniques – has become increasingly crucial for successful growth and solid financial performance. Valuation Process Steps Highlighted below are some of …

SPACs – What are they and why do they matter?

“SPAC, SPAC, SPAC!” is what many business podcasts, newspapers and news outlets have been repeating to everyone listening. “Special Purpose Acquisition Companies” aka“SPACs”, have garnered the attention of many as they continuously break funding and deal volume records. SPACs, also referred to as “blank check companies,” have been around for decades and are formed to …

TikTok, Oracle & Walmart – What You Need to Know and What Could Have Been

A complex narrative surrounds TikTok, the most downloaded app of 2020. The popular video-sharing social media platform is owned by a Chinese company, ByteDance, which was valued at $180 billion at the end of 2020. Although the app was initially released in September 2016, it did not start gaining recognition until August 2018 when ByteDance …

Q1 2021 Yachting Market Deals Lead to Greater Portfolio Breadth and Expanded Geographic Distribution

Companies that incorporate mergers and acquisitions into their long-term strategic planning may be better positioned to take advantage of macro- and microeconomic conditions that impact deal-making in their favor. The 2020 challenges impacted and continue to impact all industries, however unequally. In yachting, reports in the months of March, April and May highlighted challenging times …

4 Ways to take your Credit Union to the Next Level

In today’s dynamic economic environment, credit unions continue to face regulatory challenges and competition from challengers as well as big banks with big pocketbooks. The industry actually experienced a membership decline last year. In order to thrive in this environment, credit unions must take a proactive approach to growth and seek new opportunities to expand. …

4 things to do after you sign the LOI

The Letter of Intent (LOI) is one of the most commonly used tools for moving a deal forward. Once you receive a signature on the LOI from the seller, you have reached a significant landmark on the acquisition roadmap. Despite this milestone, there is still a lot of work to be done before the deal …

Four Reasons Why You Should Hire an M&A Advisor

Should you hire an advisor for mergers and acquisitions? Some companies execute acquisitions on their own and are successful. In fact, there are entire corporate development divisions whose primary focus is to pursue external growth initiatives for the company. On the other hand, many companies do engage an M&A advisor to guide them through the …