Capstone Strategic, Inc. is pleased to announce that Anna Kochkina has been promoted to the position of Director, Valuation Services. In her new capacity, she will oversee all aspects of the M&A valuation services Capstone provides to clients including valuation of business interests, designing financial models, and conducting risk assessments. “This promotion is well-deserved. Our …

Category: Capstone News

What’s Next in Healthcare Mergers & Acquisitions

Capstone CEO and Founder David Braun is the author of an article for Managed Healthcare Executive magazine. The article examines recent merger activity within the healthcare industry and looks at potential future trends in healthcare M&A. Read the entire article at: https://www.managedhealthcareexecutive.com/view/what-s-next-in-healthcare-mergers-acquisitions

Manufacturing Growth Through Acquisition: What to Know and What to Ask

In the current issue of Supply Chain Management Review, Capstone CEO David Braun offers both advice, and some vital questions to answer for those manufacturing and supply chain companies who may be considering growth through acquisition. https://www.scmr.com/article/manufacturing_growth_through_acquisition_what_to_know_and_what_to_ask

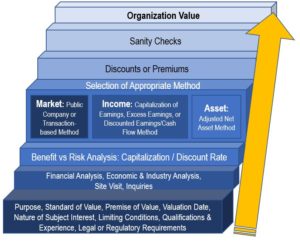

Credit Unions: Valuation Process Steps

With the rising number of credit union mergers, the increasing interest in acquisitions of community banks and branches, as well as investments in fintechs by credit unions and CUSOs, understanding valuation – processes and techniques – has become increasingly crucial for successful growth and solid financial performance. Valuation Process Steps Highlighted below are some of …

TikTok, Oracle & Walmart – What You Need to Know and What Could Have Been

A complex narrative surrounds TikTok, the most downloaded app of 2020. The popular video-sharing social media platform is owned by a Chinese company, ByteDance, which was valued at $180 billion at the end of 2020. Although the app was initially released in September 2016, it did not start gaining recognition until August 2018 when ByteDance …

Q1 2021 Yachting Market Deals Lead to Greater Portfolio Breadth and Expanded Geographic Distribution

Companies that incorporate mergers and acquisitions into their long-term strategic planning may be better positioned to take advantage of macro- and microeconomic conditions that impact deal-making in their favor. The 2020 challenges impacted and continue to impact all industries, however unequally. In yachting, reports in the months of March, April and May highlighted challenging times …

4 Ways to take your Credit Union to the Next Level

In today’s dynamic economic environment, credit unions continue to face regulatory challenges and competition from challengers as well as big banks with big pocketbooks. The industry actually experienced a membership decline last year. In order to thrive in this environment, credit unions must take a proactive approach to growth and seek new opportunities to expand. …

4 things to do after you sign the LOI

The Letter of Intent (LOI) is one of the most commonly used tools for moving a deal forward. Once you receive a signature on the LOI from the seller, you have reached a significant landmark on the acquisition roadmap. Despite this milestone, there is still a lot of work to be done before the deal …

4 Tips for Taking a Strategic Approach to M&A in 2021

Acquisition can be a powerful tool for accelerating your company’s growth. 2021 may be the year you build on your capabilities, add new services or products, or enter new markets. However, it is important not to get swept away in excitement of a potential deal and remain strategic in your thinking. As you consider growing …